RESOURCES

Chetak has the expertise to optimize your supply chain with tools that can help strengthen supplier relationships, reduce costs, balance inventory, improve customer service, and mitigate risk, thus delivering sustainable competitive advantage wherever you operate worldwide. We provide services that extend beyond the standard receiving, storing and shipping of products.

Frequently Asked Questions (FAQ)

Welcome to the Chetak Group, FAQ section. We regularly update the FAQ section to provide the correct information to our customers & prospects. We are sure you will find the answers helpful and informative. Please let us know if you encounter any problems or have any suggestions through our Contact Us section.

Note: An e-way bill cannot be cancelled if it has been verified in transit where the mode of conveyance has changed.

The invoice or bill of supply or delivery challan

AND

A copy of the e-way bill OR the e-way bill number, either physically or mapped to a RFID (Radio Frequency Identification Device). RFID is embedded on to the conveyance (mode of transport). Details of these will be notified by the commissioner. However, the commissioner may notify person-in-charge to carry the following documents instead of the e-way bill – Tax invoice or bill or supply of bill of entry OR

A delivery challan, where goods are transported other than by way of ‘supply’

A registered person can submit a tax invoice in Form GST INV-1 on the common portal. After which he will get an Invoice Reference Number (IRN). IRN is valid for 30 days from the date of uploading. It can be given for verification by an officer instead of the tax invoice. Note that where a registered person uploads the invoice, information in Part A of Form GST INS-1 is auto populated from GST INV-1.

The commissioner may notify for a class of transporters to get unique RFID. This RFID will be embedded on to the conveyance (mode of transport) and mapped to the e-way bill before the movement of goods.

What is the process for stopping of vehicles and verification of documents in transit?

Any mode of transport can be stopped for inter-state and intra-state movements. The Commissioner, or an officer empowered by him, may authorize an officer to stop a consignment to verify e-way bill.

RFID readers will be installed at places where verification of movement of goods is required. Verification will be done through RFID readers where e-way bill is mapped with RFID.

Physical verification of conveyances may also be done. In case there is ‘specific information’ of tax evasion, physical verification of a conveyance can also be done by an authorised officer.

Goods will be inspected only once during a journey. However, if any ‘specific information’ of tax evasion is available even after an inspection is already done, the vehicle can be stopped again.

If a vehicle is intercepted or stopped or detained for more than 30 minutes the transporter can upload this information in Form GST EWB-04 on the common portal.

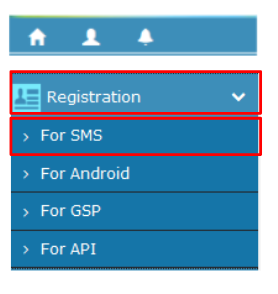

E-way bill can also be generated or cancelled through SMS.

When an e-way bill is generated a unique e-way bill number (EBN) is allocated and is available to the supplier, recipient, and the transporter.

In relation to a ‘supply’

For reasons other than a ‘supply’ (say a return)

Due to inward ‘supply’ from an unregistered person

A supply made for a consideration (payment) in the course of business

A supply made for a consideration (payment) which may not be in the course of business

A supply without consideration (without payment) In simpler terms, the term ‘supply’ usually means a:

1. Sale – sale of goods and payment made

2. Transfer – branch transfers for instance

3. Barter/Exchange – where the payment is by goods instead of in money

Therefore, e-Way Bills must be generated on the common portal for all these types of movements.

1. The mode of transport is non-motor vehicle

2. Goods transported from port, airport, air cargo complex or land customs station to Inland Container Depot (ICD) or Container Freight Station (CFS) for clearance by Customs.

3. The distance between the consigner or consignee and the transporter is less than 10 Kms and transport is within the same state.

4. Transport of specified goods (PDF of List of Goods).

DON’T OPEN THE LINK ONLY SAVE THE PDF FILE

Unregistered Persons – Unregistered persons are also required to generate e-Way Bill. However, where a supply is made by an unregistered person to a registered person, the receiver will have to ensure all the compliances are met as if they were the supplier.

Transporter – Transporters carrying goods by road, air, rail, etc. also need to generate e-Way Bill if the supplier has not generated an e-Way Bill.

| Who | When | Part | Form |

|---|---|---|---|

| Every Registered person under GST | Before movement of goods | Fill Part A | Form GST EWB-01 |

| Registered person is consignor or consignee (mode of transport may be owned or hired) OR is recipient of goods | Before movement of goods | Fill Part B | Form GST EWB-01 |

| Registered person is consignor or consignee and goods are handed over to transporter of goods | Before movement of goods | Fill Part B | The registered person shall furnish the information relating to the transporter in Part B of FORM GST EWB-01 |

| Transporter of goods | Before movement of goods | Generate e-way bill on basis of information shared by the registered person in Part A of FORM GST EWB-01 | |

| An unregistered person under GST and recipient is registered | Compliance to be done by Recipient as if he is the Supplier. | Canada | Canada |

| Magazzini Alimentari Riuniti | Giovanni Rovelli | 1. If the goods are transported for a distance of ten kilometers or less, within the same State/Union territory from the place of business of the consignor to the place of business of the transporter for further transportation, the supplier or the | |

| transporter may not furnish the details of conveyance in Part B of FORM GST EWB-01. | |||

| 2. If supply is made by air, ship or railways, then the information in Part A of FORM GST EWB-01 has to be filled in by the consignor or the recipient |

If both the consignor and the consignee have not created an e-way bill, then the transporter can do so by filling out PART A of FORM GST EWB-01 on the basis of the invoice/bill of supply/delivery challan given to them.

| Distance | Validity of EWB |

|---|---|

| Less Than 100 Kms | 1 Day |

| For every additional 100 Kms or part thereof | additional 1 Day |

2. Transport by road – Transporter ID or Vehicle number.

3. Transport by rail, air, or ship – Transporter ID, Transport document number, and date on the document.

E-way bills in EWB-01 can be generated by either of two methods:

1. On the Web

2. Via SMS

This topic covers the step-by-step process of generating the e-way bills on the E-way bill portal (web-based).

There are some pre-requisites for generating an e-way bill (for any method of generation):

1. Registration on the EWB Portal

2. The Invoice/ Bill/ Challan related to the consignment of goods must be in hand.

3. If transport is by road – Transporter ID or the Vehicle number.

4. If transport is by rail, air, or ship – Transporter ID, Transport document number, and date on the document.

Here is a step by step Guide to Generate E-Way Bill (EWB-01) online:

Step 1: Login to e-way bill system.

Enter the Username, password and Captcha code, Click on ‘Login’

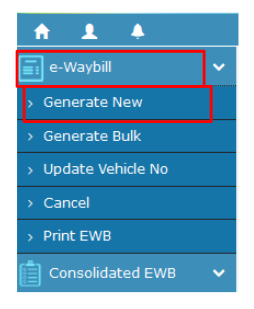

Step 2: Click on ‘Generate new’ under ‘E-waybill’ option appearing on the left-hand side of the dashboard.

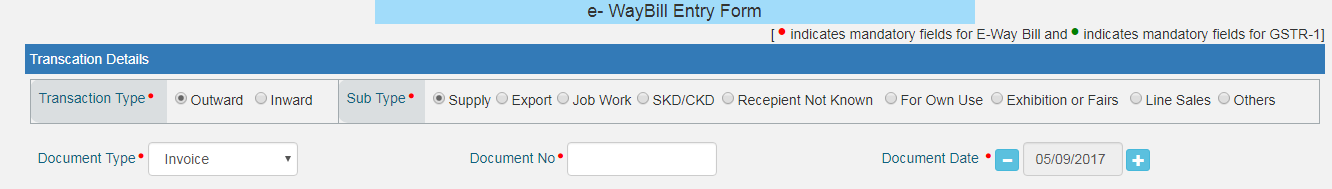

Step 3: Enter the following fields on the screen that appears:

1) Transaction Type:

Select ‘Outward’ if you are a supplier of consignment

Select ‘Inward’ if you are a recipient of consignment.

2) Sub-type: Select the relevant sub-type applicable to you:

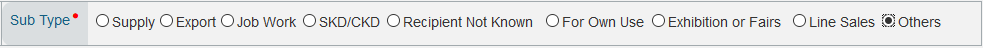

If transaction type selected is Outward, following subtypes appear:

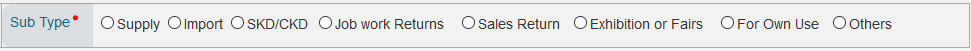

If transaction type selected is Inward, following subtypes appear:

Note: SKD/CKD- Semi knocked down condition/ Complete knocked down condition

3) Document type: Select either of Invoice / Bill/ challan/ credit note/ Bill of entry or others if not Listed

4) Document No.: Enter the document/invoice number

5) Document Date: Select the date of Invoice or challan or Document.

Note: The system will not allow the user to enter the future date.

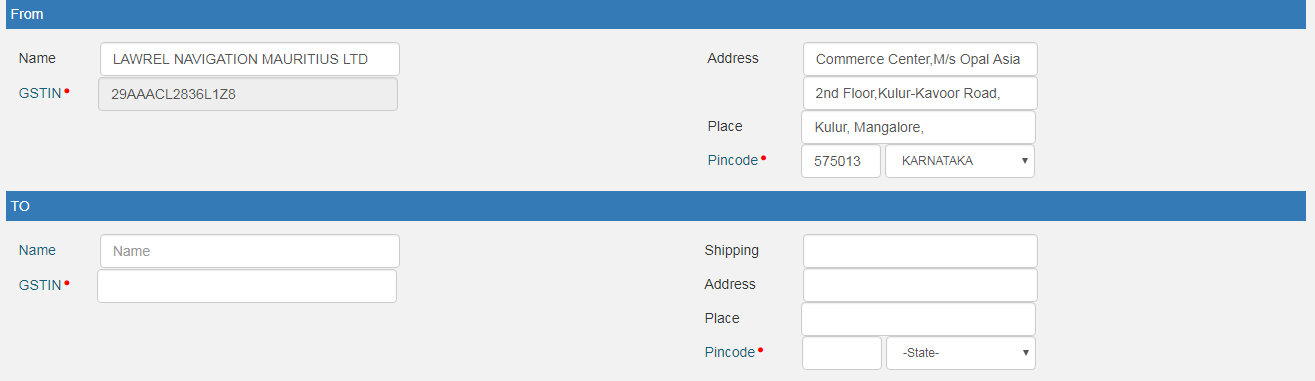

6) From/ To: Depending on whether you are a supplier or a recipient, enter the To / From section details.

Note: If the supplier/client is unregistered, then mention ‘URP’ in the field GSTIN, indicating that the supplier/client is an ‘Unregistered Person’.

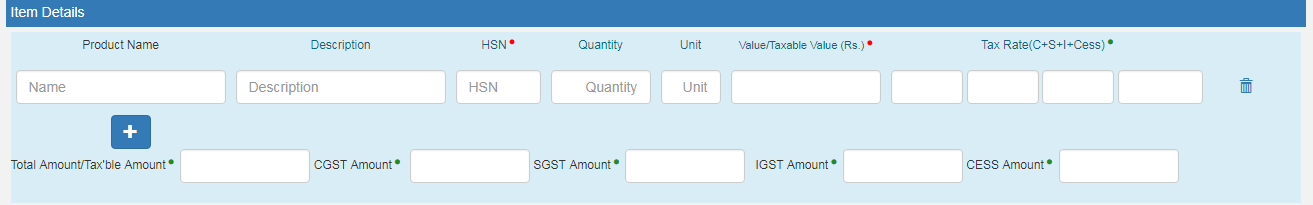

7) Item Details: Add the details of the consignment (HSN code-wise) in this section:

1. Product name

2. Description

3. HSN Code

4. Quantity

5. Unit

6. Value/Taxable value

7. Tax rates of CGST and SGST or IGST (in %)

8. Tax rate of Cess, if any charged (in %)

Note: On the implementation of E-way bills, based on the details entered here, corresponding entries can also be auto-populated in the respective GST Return while filing on GST portal.

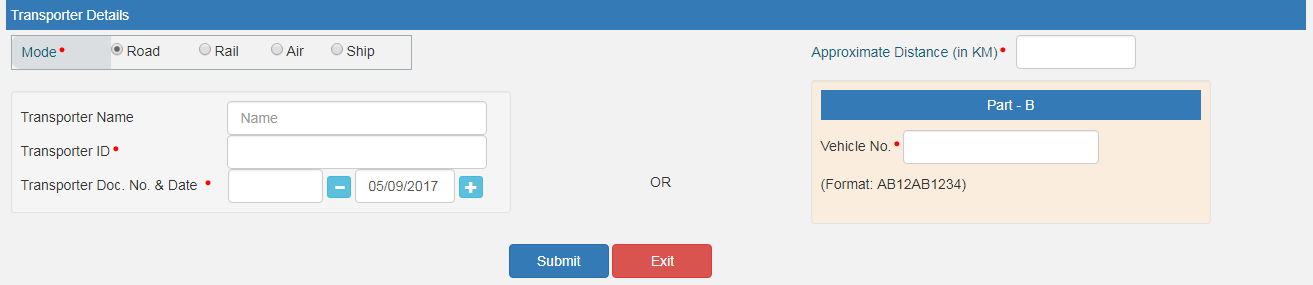

8) Transporter details: The mode of transport(Road/rail/ship/air) and the approximate distance covered (in KM) needs to be compulsorily mentioned in this part.

Apart from above, Either of the details can be mentioned:

1. Transporter name, transporter ID, transporter Doc. No. & Date.

OR

2. Vehicle number in which consignment is being transported.

Format: AB12AB1234 or AB12A1234 or AB121234 or ABC1234

Note: For products, clients/customers, suppliers, and transporters that are used regularly, first update the ‘My masters’ section also available on the login dashboard and then proceed.

Step 4: Click on ‘Submit’. The system validates data entered and throws up an error if any.

Otherwise, your request is processed and the e-way bill in Form EWB-01 form with a unique 12 digit number is generated.

The e-way bill generated looks like this:

Print and carry the e-way bill for transporting the goods in the selected mode of transport and the selected conveyance.

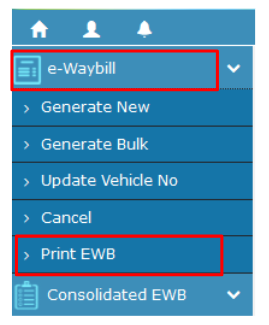

You can print the e-way bill anytime as follows:

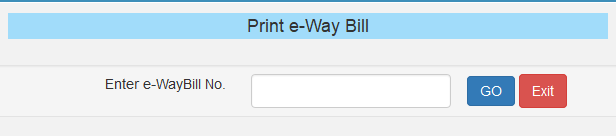

Step-1: Click on ‘Print EWB’ sub-option under ‘e-Waybill’ option

Step-2: Enter the relevant e-way bill number -12 digit number and click on ‘Go’

Step-3: Click on ‘Print’ or ‘detailed print’ button on the EWB that appears:

If you are a transporter/ supplier who wants to transport multiple consignments of goods in a single conveyance or vehicle, you can use the Consolidated E-Way Bill feature available on the E Way Bill portal.

Note: You should be a transporter or should have generated the e-way bills at step-1 yourself to use the consolidated EWBs facility.

Prerequisites:

1. Registration on the EWB Portal

2. You should have the Invoice/ Bill/ Challan related to the consignment of goods.

3. Transporter ID or the Vehicle number (for transport by road).

4. Transporter ID, Transporter document number, and date on the document (for transport by rail, air, or ship).

5. Apart from those, the taxpayer must have all the individual e-Way Bill numbers of the consignments, to be transported in one conveyance.

Here is a step-by-step process to generate consolidated e-way bills:

Step 1: Login on EWB Portal and Generate Individual E-way bills.

Here is a step by step guide to generate E-way bill.

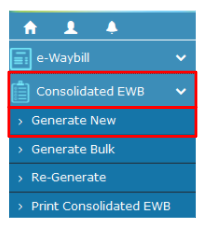

Step 2: Select ‘Generate new’ under ‘Consolidated EWB’ option appearing on the left-hand side of the dashboard.

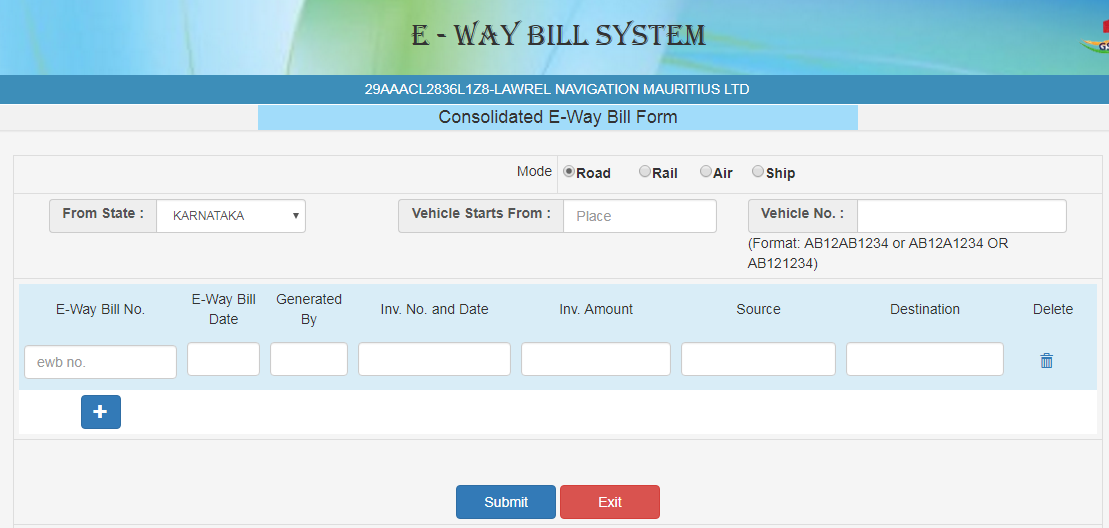

Step 3: The following details are required to be entered in this step:

1. Select ‘Mode’ of transport- Rail/Road/Air/Ship

2. Select ‘From State’ from the drop down

3. In the ‘Vehicle Starts From, field enter the location from where the goods are being transported.

4. Enter ‘Vehicle No.’

5. Add the EWB no. (rest of the fields are auto-populated based on this)

Enter the details and Click on ‘Submit’

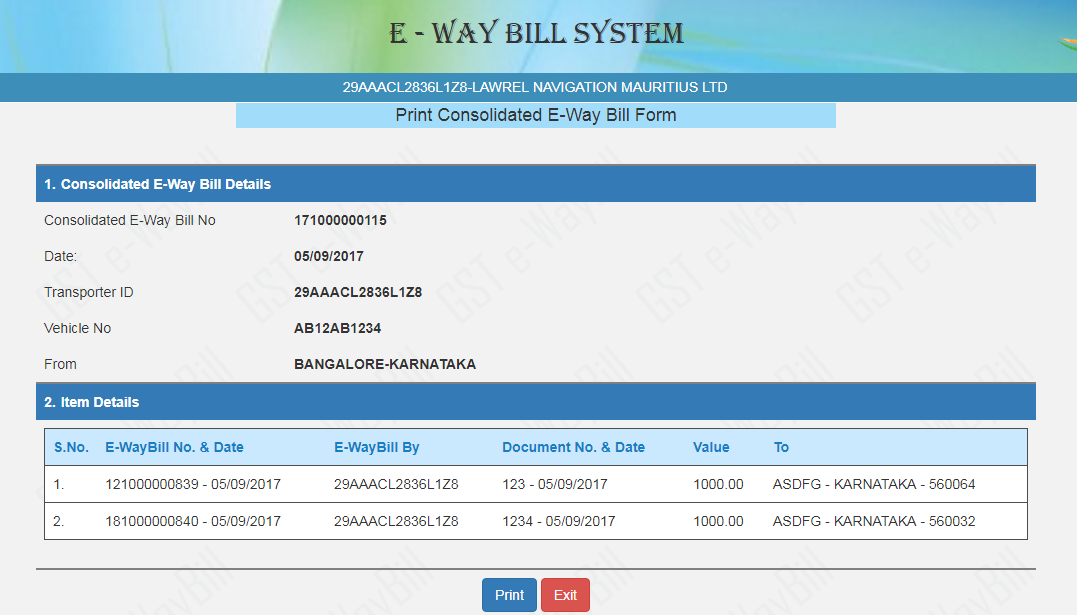

On submitting, following screen appears:

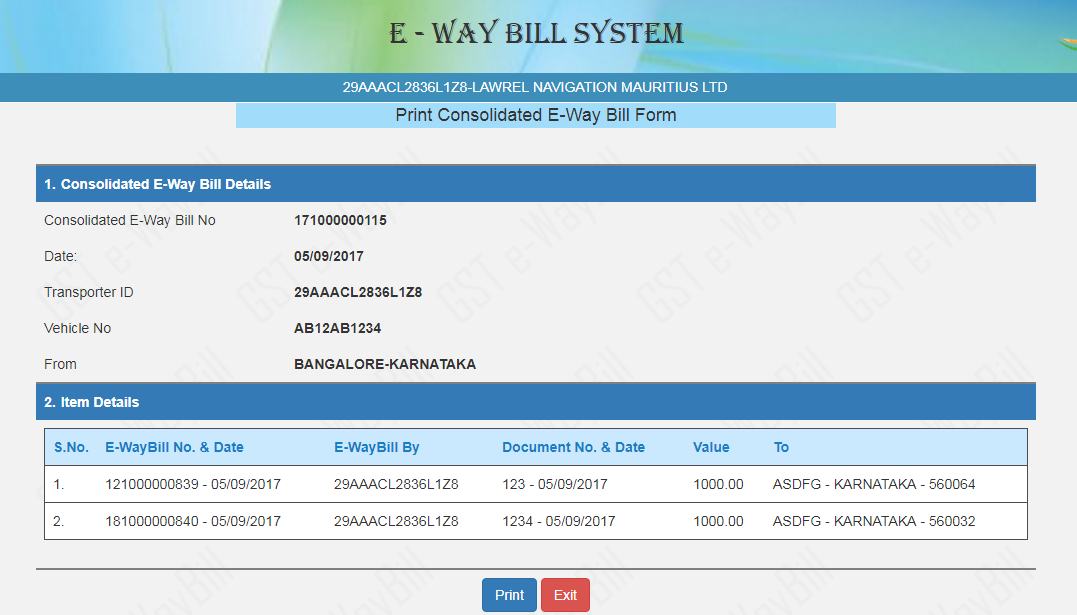

E-way bill in Form EWB-02 with a unique 12 digit number is generated.

Print and carry this for transporting the goods in the selected mode of transport and the selected conveyance.

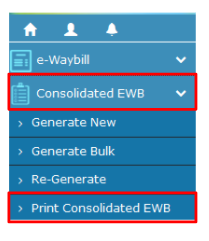

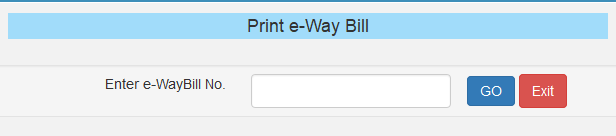

You can print the Consolidated EWBs as follows:

Step-1: Click on ‘Print EWB’ sub-option under ‘e-Waybill’ option or ‘Consolidated EWB’ option

Step-2: Enter the relevant e-way bill number/ Consolidated EWB -12 digit number and click on ‘Go’

Step-3: Click on ‘Print’ or ‘detailed print’ button on the EWB/ consolidated EWB that appears:’

1. Web Based2. via SMS A person who wants to generate multiple e-way bills can use the web-based facility.

Users who intend to generate a single E-Way Bill or users who do not have the facility to access the website can use the SMS facility to generate E-Way Bills.

SMS facility in EWB also helps at times of emergencies or urgency for many big businesses as well.

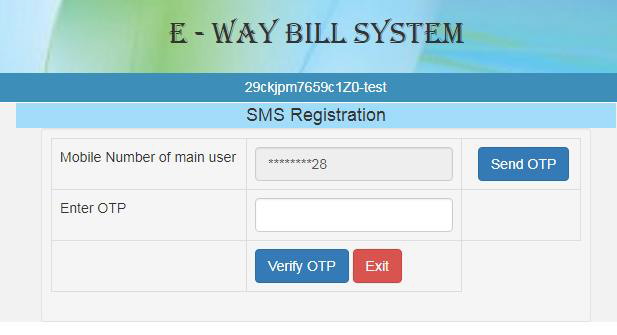

The mobile number registered for the GSTIN gets partly displayed. Click on ‘Send OTP’. Enter the OTP generated and click on ‘Verify OTP’.

Only those mobile numbers that are registered with

For example, a logistics department would receive supplies, give components to a production line, move finished goods to a distribution center, manage inventory and ship products to a customer.

Logistics teams are responsible for making sure each of these steps run smoothly, including purchasing, accepting inbound delivery, storage, packaging, inventory management, shipping, outbound transportation and delivery. Choreographing these processes gets complicated when volume grows and there are multiple products to manage. Companies that use several distribution channels and operate facilities in different locations face another layer of complexity.

| ATTRIBUTE | INBOUND LOGISTICS | OUTBOUND LOGISTICS |

| Direction | Inward | Outward |

| Focus | Supply | Demand |

| Role | Receiving | Delivery |

| Key Relationships | Suppliers, vendors and their distributors | Distributors, wholesalers, retailers, end customers |

| Processes | Sourcing, procurement, materials handling, put away | Inventory management, order fulfilment, shipping |

| Activity | Raw materials or goods coming in from suppliers | Finished products going out to customers |

| Strategic Imperative | Obtaining goods or materials the company needs to make its products | Meeting customer demand, supporting the sales process to generate revenue |

Inbound logistics is the way materials and other goods are brought into a company. This process includes the steps to order, receive, store, transport and manage incoming supplies. Inbound logistics focuses on the supply part of the supply-demand equation.

Inbound Logistics Activities

- Sourcing and procurement : Identifying and evaluating potential suppliers, obtaining price quotes, negotiating with and managing suppliers.

- Ordering/purchasing : Buying the goods and materials the company needs so the right quantity arrives at the right time.

- Transportation : Deciding whether to use a truck, airplane, train or another method to move goods. This activity also involves selecting delivery speed for incoming supplies, contracting with third-party carriers and working with vendors on price and route.

- Receiving : Handling the arrival of new materials, unloading trucks and ensuring they match the order.

- Material handling : Moving the received goods short distances within the facility and staging them for later use.

- Put away : Moving goods from the receiving dock to storage. Staff puts everything away in assigned locations.

- Storing and warehousing : Managing the materials before they go to manufacturing or customer fulfilment. This department is responsible for making sure items are placed in logical locations for fulfilment and the right storage conditions are met.

- Inventory management : Deciding the type and amount of raw materials/items you should store and where to locate them. Read the inventory management guide to learn more.

- Expediting : Managing the progress of and schedule for materials as they make their way to your facility.

- Distribution : Sending supplies to their destination inside the business.

- Tracking : Checking on details about incoming orders, such as their location and documents like receipts.

- Reverse logistics : Bringing goods back from customers for reasons such as returns, defects, delivery problems, repair and refurbishment. Also, recycling and salvage firms that work with used materials obtain their supply through reverse logistics.

The primary challenges of inbound logistics are high costs, uncertain delivery dates and unpredictable lead times. These make it hard for businesses to maintain ideal inventory levels and improve warehouse efficiency and productivity.

Here are some specific inbound logistics challenges in more detail:

- Inbound shipping inefficiencies : Some companies spend too much of their budget on shipping. To cut costs, you need to negotiate preferred rates with fewer carriers and consolidate inbound shipments to make full truckloads. You can also set vendor inbound compliance standards (VICS) on price and service. Analytics can help you identify any waste of time or money.

- Information vacuum : One frequent challenge is not knowing the exact location of a shipment, when it will arrive and how much it will cost. This lack of knowledge causes some companies to carry extra inventory, make purchases too early and suffer delays in production and customer deliveries. Real-time information systems allow a company to track and trace shipments and communicate with suppliers to make sure accurate data is captured when entering materials.

- Surges in deliveries and receiving : Without proper planning, businesses can end up juggling too many deliveries simultaneously. As a result, their yards become clogged with trucks, causing confusion among drivers about which dock to use. Peaks and lulls in deliveries makes it hard to effectively staff receiving personnel, as well. A weak receiving process leads to errors and a backup of materials. Solutions include scheduling arrivals, routing deliveries to specific docks and maintaining a consistent pace throughout the day. Warehouse management software (WMS) can help with logistics. Another technique is cross-docking, where the receiving department matches incoming inventory to open orders. When workers unload products, they move them directly to another dock to load onto an outbound truck, without ever storing them.

- Processing returns : Returns processing is an afterthought for some companies, leading to lost sales when stock is not put back into inventory quickly. Inaccurate inventory counts and reduced customer satisfaction are additional problems. Create clear, efficient processes for returns and communicate the importance of returns management to staff to combat this issue.

- Supplier reliability : A company needs dependable suppliers that offer competitive pricing and quality. However, reliable suppliers can be difficult to find and keep. To make this easier, try steps such as:

- Build long-term relationships

- Pay suppliers on time

- Negotiate as necessary to make sure contracts align with your business goals

- Check supplier quality certifications

- Evaluate supplier risks such as political climate, weather and labor relations

- Forecast your growth patterns and pick suppliers that can scale

- Check supplier lead time and on-time delivery rate

- Assess their customer service

- Consistently evaluate alternative suppliers

- Balancing supply and demand : Ensuring there are enough incoming supplies to meet customer demand can be difficult due to seasonality, competitive influences, economic conditions, pricing volatility in raw materials, fluctuations in selling cycles and more. The best way to balance supply and demand is through data. Software can compare incoming inventory to your order pipeline. It can also monitor the status and location of inbound deliveries, predict demand based on historical patterns, find opportunities to consolidate purchases and more.

Outbound logistics focuses on the demand side of the supply-demand equation. The process involves storing and moving goods to the customer or end user. The steps include order fulfilment, packing, shipping, delivery and customer service related to delivery.

Outbound Logistics Activities

Warehouse and Storage Management : A company keeps a certain quantity of goods on hand to meet demand. Outbound logistics processes store these goods securely in the right conditions and organize them. Inbound and outbound logistics overlap in warehouse management. But outbound logistics deals with outgoing finished products. For companies that sell finished products they receive from suppliers, inbound logistics concentrates on product acquisition and outbound logistics fulfills orders sent straight to customers and distributes the products to retail outlets.

Inventory Management : Software often plays a central role in inventory management, a process that determines the best place to store goods in the warehouse for fast order fulfillment and the order picking and packing operation. Inventory management goals include inventory and order accuracy as well as maintaining product quality by preventing damage, theft, obsolescence or spoilage.

Transportation : The modes and methods of shipping products vary depending on the type of goods. For example, huge items like heavy machinery may ship in small order quantities by truck. Perishable items like fresh flowers may need to be transported by plane in refrigerated containers.

Delivery : On-time delivery is critical to success. Moreover, the customer’s order must have the correct items and quantities, and the package can’t get lost or damaged in transit. Outbound logistics takes responsibility for this step.

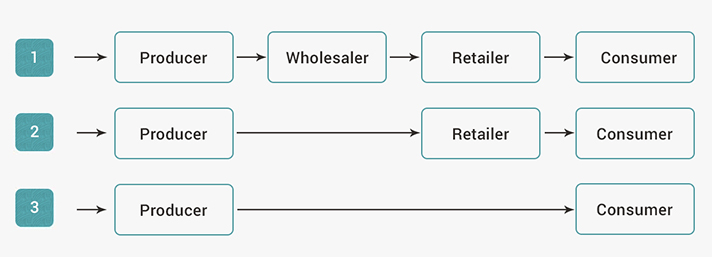

Distribution Channels : The ways your product reaches the customer, called distribution channels, affect how you organize outbound logistics. Distribution channels can be broadly categorized into direct (when you sell directly to your customers) and indirect (when you sell through an intermediary such as a wholesaler or retailer). There are many distribution methods, including direct to consumer, value-added resellers, dealer networks, dual-distribution, omnichannel and drop shipping. When choosing distribution channels, consider logistics complexity, cost, speed, quality, customer satisfaction and control

Last-mile Delivery : The final step in an order’s journey covers the last shipping leg and delivery. The last mile is usually the most costly and inefficient part of delivery. The term comes from the early days of telephone service, when wiring homes to the mainline was slow and expensive. Last-mile logistics includes services such as home grocery delivery from a local store and package delivery by a common carrier. Before the last mile, shippers can handle lots of orders at the same time in the same way (for example, they can load dozens of orders going to the same city in one truck). But in the last mile, each delivery requires individual handling because it goes to a single address. Deliveries to addresses get spread over a suburban region or packed within a gridlocked city center where parking is difficult—last-mile services account for 41% of overall supply chain costs.

Delivery Optimization : Optimizing delivery involves not only reducing costs but meeting ever-increasing customer expectations for speed and visibility. Often, these two things go hand-in-hand. Route planning software groups orders more efficiently for delivery, sorts packages by route, plots the best course with an eye to traffic, fuel consumption and other variables, and assigns routes to drivers.

Outbound logistics challenges can hurt profits and customer satisfaction. Inventory and shipping costs can rise quickly, while incorrect or late orders will drive customers away.

Coordinating Operations : Outbound logistics teams must monitor production, storage and distribution—coordinating the optimal movement of goods is no small task. If production rises, the logistics team needs to free up more warehouse space, and as production increases to meet customer demand, shipping and delivery need to scale. Software and automation can help close the information loop by connecting production to storage capacity and demand.

Achieving the Seven Rs : Coined by John J. Coyle, professor emeritus of logistics and supply chain management at Penn State University, the seven Rs are: getting the right product, to the right customer, in the right quantity, in the right condition, at the right place, the right time and at the right cost. Consistently hitting these targets requires an integrated management process that uses data to assess performance, identify areas of weakness, and track and foster continuous improvement.

Inventory Costs : Keeping enough inventory to meet fluctuating customer demand without creating unnecessary holding costs requires careful planning. Keeping a close eye on inventory planning metrics such as sell-through rate and inventory turnover and tracking numbers like safety stock and shifts in demand is important. See the comprehensive list of inventory management metrics for a list of key formulas.

Transportation Costs : A major cost for outbound logistics is transportation. Companies can control costs by analysing past spending to spot inefficiencies. Try exploring different strategies such as dynamic pricing, volume discounts with carriers, opening up bidding for your products/services and looking at freight marketplaces.

Rising Customer Expectations : Consumer demands continue to climb, and free, fast delivery is now the expectation. Same-day and even two-hour delivery are the norms in some regions and industries. Customers want real-time visibility into the status of their orders and to be able to track them on a map. To meet this trend, logistics teams need to understand the role of delivery as a competitive differentiator and the lasting effect of a poor customer delivery experience.

Optimizing inbound logistics means making the operation faster, leaner, more cost-efficient and more agile. Assess every process, identify strengths and weaknesses, and then make improvements.

1. Model your current process and measure performance.

Look for inefficiencies related to cost, waste, quality loss, duplicate work, information gaps and delays. The presence of invisible or intangible costs in inbound logistics, such as inventory carrying costs and the impact of poor customer service, can complicate matters. Compare your operation to industry benchmarks and competitors.

2. Analyze your choices.

Understand how your decisions affect cost and efficiency. For example, if the procurement department makes purchases in large quantities to receive volume discounts, are those savings offset by the expense of holding and managing excess inventory? The major cost drivers for inbound logistics are purchasing, supplier management, transportation, receiving, warehousing, material handling and inventory management.

3. Develop strategies to address inefficiencies system-wide.

Account for trade-offs among activities. Investing in automation and analytics will enable more data-driven decision-making.

Some of the most widely recommended actions to optimize inbound logistics include:

1. Build strong relationships with suppliers : Strong supplier partnerships can yield benefits such as better terms, reduced lead time, cost savings and a sense of security during market fluctuations.

Prioritizing this relationship helps your supplier understand your business better. A supplier compliance plan explains your requirements and penalties for mistakes such as late delivery or not following route guidelines. Such a program can reduce freight and warehouse costs, improve speed and accuracy, and increase customer satisfaction.

2. Use a transportation management system (TMS) : This software automates, manages and optimizes freight operations. A TMS compares shipping quotes and service levels among carriers, schedules the shipment and tracks it through delivery. These details help a company reduce costs, increase efficiency and gain full visibility into its supply chain.

3. Use a warehouse management system (WMS) : WMS software optimizes warehouse operations by streamlining receiving, put away, inventory management, picking and more.

4. Combine deliveries : Less-than-truckload (LTL) shipments have higher shipping costs and longer receiving times. Sometimes there are barriers to consolidating shipments, such as different handling needs (some goods need refrigeration, for example). If a business struggles to make full truckloads, a third-party logistics provider (3PL) can combine its partial loads with those of other customers.

Logistics is just one piece of supply chain management. Supply chain management manages all the links among suppliers, producers, distributors and customers.

Other elements of supply chain management include manufacturing and delivery-related customer service. Logistics helps synchronize the supply chain by controlling the flow of goods from the point of origin to the point of consumption. Participants in the supply chain, like suppliers and buyers, find partnerships helpful. Two firms work together for their mutual benefit. These partnerships are often open-ended, unlike strategic alliances or project partnerships.

Supply chain partnerships require:

- Frequent and open two-way communication

- Cooperation on accurate, efficient order execution

- Coordinated decision-making

- Sharing of resources

- Information and knowledge exchange

The most important partnerships include suppliers and vendors on the supply side. On the demand side, the critical ties are among logistics providers, retailers, wholesalers, distributors and end customers.

Suppliers may collaborate closely with important customers on product formulation, product size, product mix, SKUs, inventory levels, supply forecasts, risk management, cost control, waste reduction and ordering systems. The customer may want to work together with logistics providers on pacing, packaging, scheduling and route efficiency.

Supply chain management looks collectively at multiple business activities to achieve a competitive advantage. Logistics focuses on the flow of goods to meet customer needs.

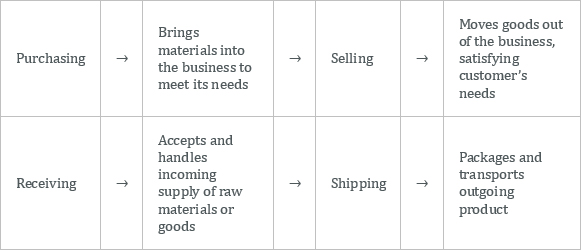

Role of Logistics in Purchasing and Receiving Purchasing/Selling Receiving/Shipping

Diagram showing the relationship between purchasing and selling and receiving and shipping:

Inbound and outbound logistics break down into many specific steps. Together, the steps help ensure the smooth movement of goods and materials into and out of a business.